Increasing claims ratio figures signify increasing expectations of damages to be paid by insurance companies as the relationship of income and expenditure in the relevant insurance segment is changing. Such considerations play an important role in terms of an insurance company’s balance sheet. In 2021, storms and hailstones as well as other natural hazards – especially the flood catastrophe resulting from the low-pressure system ‘Bernd’ in July in the Rhineland-Palatinate and North Rhine-Westphalia – caused damage to residential buildings, household effects, trade, industry and agriculture, amounting to a total of 11 billion Euros. This makes 2021 – followed in second place by 1990 with a damages total of 10.8 billion Euros owing to the severe hurricanes named Daria, Vivian and Wiebke, and in third place by 2002 with insured damage amounting to 10.3 billion Euros resulting from the August floods focused on the Elbe/Danube area (cf. Indicator WW-I-4) – the most expensive year in terms of damages paid by underwriters in the course of the past 50 years.213

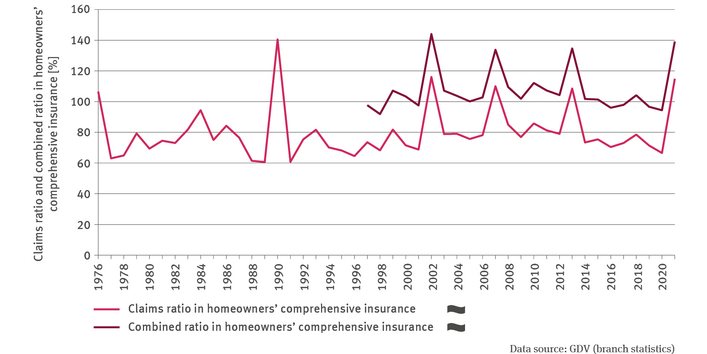

Whether an insurance segment is profitable is indicated by the so-called combined ratio. The storm events of recent years left their mark on the combined ratio of homeowners’ insurance. Where the ratio exceeds 100 %, this signifies that this is a loss-making business for the insurance company. In the segment of homeowners’ comprehensive insurance, the combined ratio is usually comparatively high. This regularly causes actuarial losses incurred by insurance companies. The data collected by insurance companies have been collated centrally for the past 25 years. Looking back at this period of time, it becomes evident that up to 2015, German insurance companies managed to make an actuarial profit only in three years (1997, 1998 and 2001) as far as the homeowners’ comprehensive insurance segment is concerned. Between 2002 and 2014 the insurers of homeowners’ properties accumulated an actuarial minus of more than 7 billion Euros. For a long time the competition on price in the field of homeowners’ comprehensive insurance was very keen, which made insurance companies hesitant to adapt the calculation of the premiums charged by them. Since the end of the price war over homeowners’ insurance and the resulting increase in premiums, the combined ratio for 2016 and 2017 as well as 2019 and 2020 reverted to below 100 %. Consequently, in those years it was possible again to achieve an actuarial profit in the field of homeowners’ comprehensive insurance. However, the severe damage year of 2021 disrupted this positive development very suddenly. So far it has not been possible to identify a statistically significant trend in respect of the combined ratio.

Looking at the time series for the claims ratio – which does not include the costs of administration and contract conclusion, thus not permitting any immediate statements on the profitability of the insurance business – the picture is quite similar. There is no discernible trend in this respect either.

RIf insurance companies want to avoid charging their insured clients further premium increases, they will probably have to demand more personal provision by the insured themselves. This means that homeowners will have to become proactive themselves by proving that, thanks to architectural measures, they have been able to achieve better protection of their buildings from the impacts of natural hazards. Furthermore, the systematic embedding of the adaptation to climate change in the building regulations law – down to the decree of building bans in exposed areas – is required in order to reduce the risks involved (cf. Indicator RO-R-6). An expansion of insurance protection – especially with regard to natural hazards insurance – in order to achieve greater insurance density (cf. Indicator BAU-R-4) is likely to help spreading the risk more widely. After all, it can be assumed that not all regions of Germany will be affected in equal measure by individual natural hazard events.

The insurance industry currently works on the premise that it will remain possible to provide insurance in Germany for damage caused by natural hazards despite being faced by climate change, and therefore advocates risk-based market solutions. However, nobody can predict with certainty, in what way the damage scenario might evolve in future. This is why insurance companies campaign for an instrument which strives for active state support in cases of disastrous cumulative damage, thus creating a buffer to absorb some of the extreme social losses and burdens incurred by the insured214.

213 - GDV – Gesamtverband der Deutschen Versicherungswirtschaft e.V. (Hg.) 2022: Naturgefahrenreport 2022. Zahlen, Stimmen, Ereignisse. Berlin, 58 pp. https://www.gdv.de/resource/blob/105828/0e3428418c45df91f7ee5f280a5a9bff/download-naturgefahrenreport-2022-data.pdf

214 - GDV 2021: Versicherung gegen Naturgefahrenereignisse in Deutschland – Gesamtkonzept der deutschen Versicherer. Berlin, 4 pp. https://www.gdv.de/resource/blob/71796/6f0fb2efaf19015693e6051a36bb1c0d/pdf-data.pdf