Indicator: Taxes related to the environment

Revenue from taxes to the environment

Quelle: Federal Statistical Office of Germany

Revenue from taxes to the environment

Quelle: Federal Statistical Office of Germany

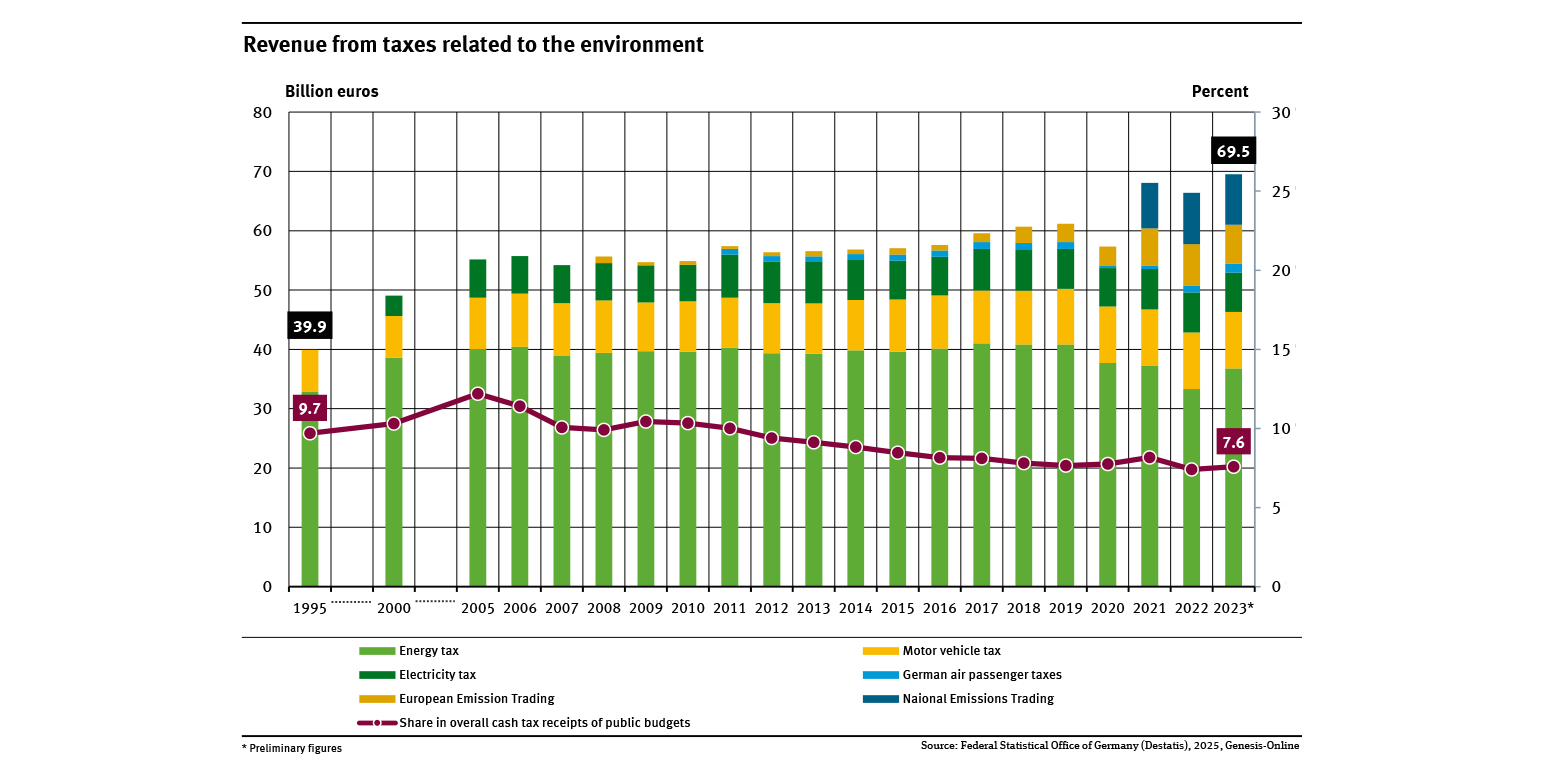

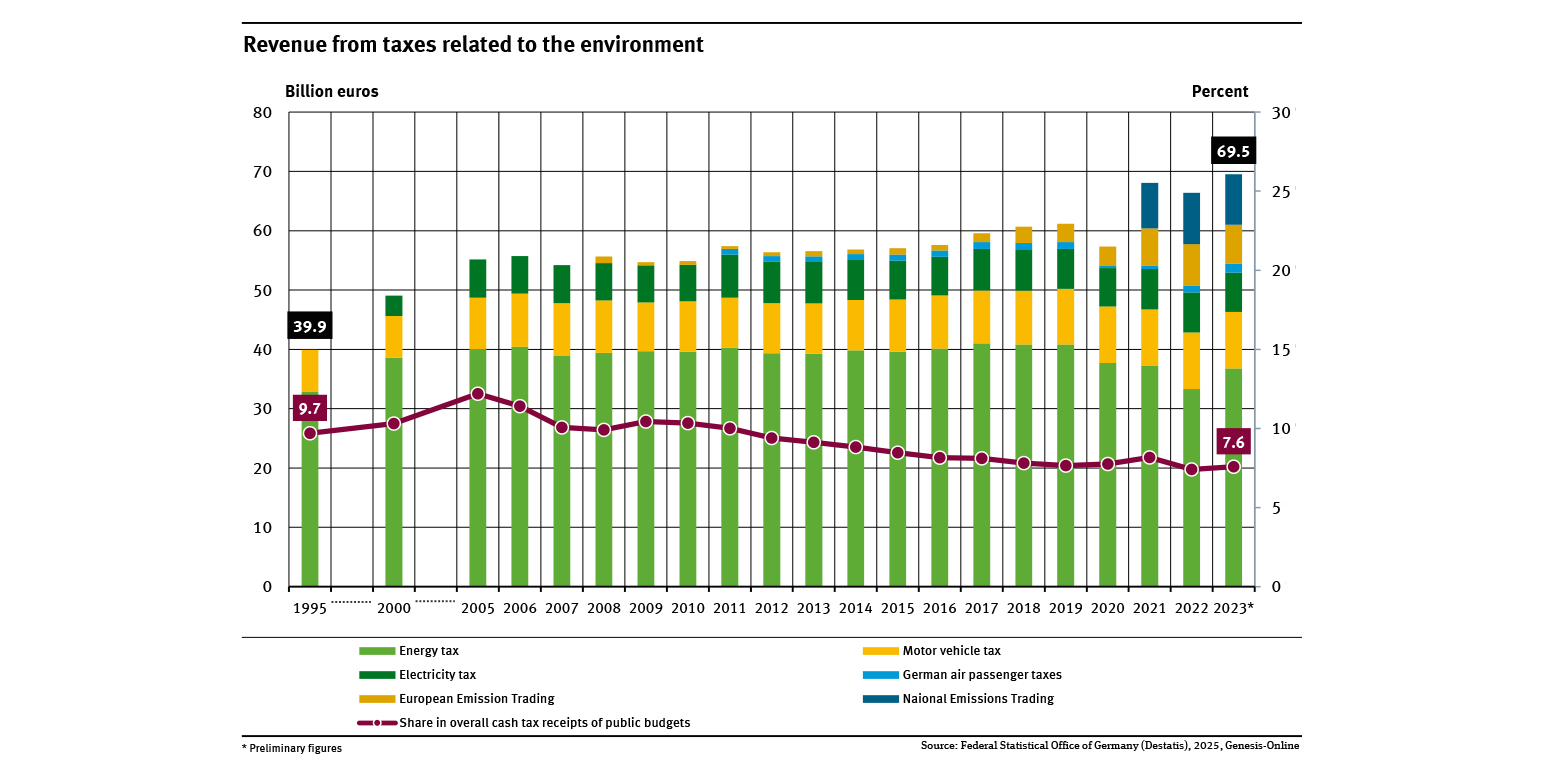

- In 2023, environmental taxes amounted to a total of 69.5 billion euros.

- Their share of total taxes has been on a downward trend since 2005 and now stands at 7.6 %.

- The highest-yielding environmental taxes are the energy tax, the motor vehicle tax. and revenue from national emissions trading.

Environmental taxes are effective tools for tackling ecological challenges that arise, for instance, from the consumption of energy and resources. A higher price encourages companies and private households to consider the environmental cost of products when deciding on production methods and purchases. In addition, companies are motivated to develop new environmentally friendly technologies, which will give them the opportunity to improve their international competitiveness.

The manufacturing industry and agriculture and forestry benefit from tax breaks for electricity, heating oil and gas, while the service sector and private households are more heavily taxed. A large part of the revenue from the ecological tax reform fund the state pension scheme, thus lowering pension contributions. Revenue from the auctioning of emission permits in emissions trading is also recorded as part of this statistic on environment-related taxes.

In 2023, revenue from environment-related taxes amounted to 69.5 billion euros. The largest proportion came from the energy tax (36.8 billion euros), followed by the motor vehicle tax (9.5 billion euros) and the revenue from national emissions trading (8.5 billion euros).

Environmental taxes rose by 26 % between 2005 and 2023, whereas overall taxes increased by 102.6 %. Therefore, environmental taxes now account for only 7.6 % of overall tax revenue. In 2005, their share had been 12.2 %.

The introduction of the Ecological Tax Reform in 1999 led to a substantial rise in revenue from environmental taxes until 2005. Revenue from environmental taxes fell slightly by 2010 because the Ecological Tax Reform led to a more economical use of energy and electricity. Furthermore, price increases and inflation had no effect on tax revenue, as the taxes are quantity taxes (e.g. 2 cents per kilowatt hour of electricity).

The concept of statistics on environmental taxes was developed at an international level by the Organisation for Economic Co-operation and Development (OECD) and the Statistical Office of the European Union (Eurostat 2013). Reports on the development of environmental taxes are part of the Environmental Economic Accounting of the Federal Statistical Office of Germany (Destatis 2025).

More information: 'Umweltbezogene Steuern und Gebühren' (in German only).