Indicator: Taxes related to the environment

Click to enlarge

Click to enlargeSource: Federal Statistical Office of Germany Figure as PDF

Umweltbundesamt

Umweltbundesamt

Click to enlarge

Click to enlarge

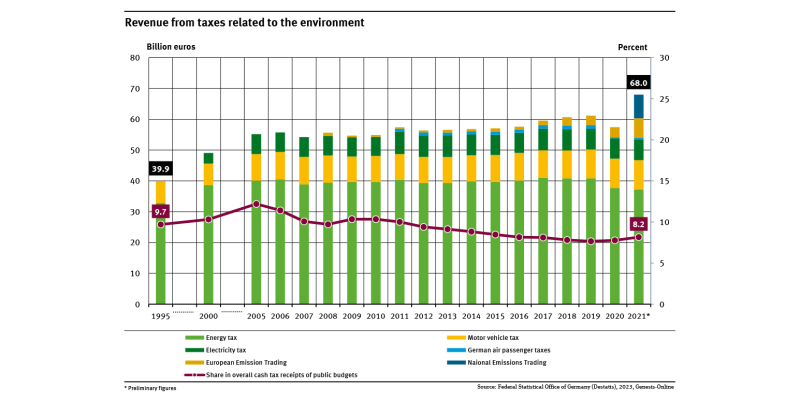

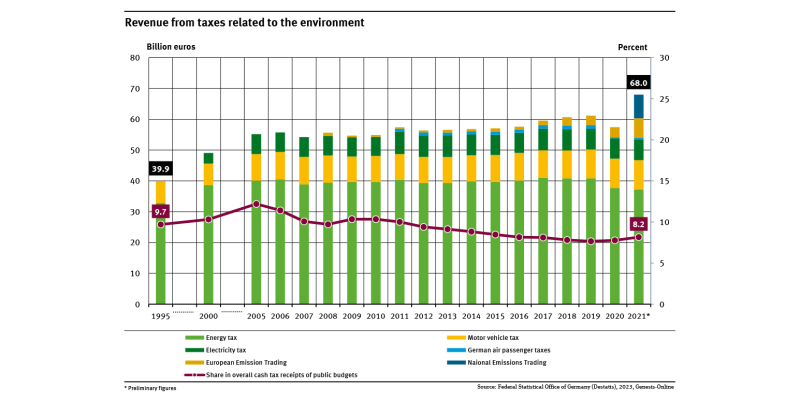

- The most important environmental taxes are energy, motor vehicle and revenues from national emissions trading.

- In 2021, environmental taxes amounted to a total of 68 billion euros.

- The share of total taxes has been on a downward trend since 2005 and now stands at 8.2 %.

Environmental taxes are effective tools for tackling ecological challenges that arise, for instance, from the consumption of energy and resources. A higher price encourages companies and private households to consider the environmental cost of products when deciding on production methods and purchases. In addition, companies are motivated to develop new environmentally friendly technologies, which will give them the opportunity to improve their international competitiveness.

The manufacturing industry and agriculture and forestry benefit from tax breaks for electricity, heating oil and gas, while the service sector and private households are more heavily taxed. Approximately 90 % of the revenue from the ecological tax reform fund the state pension scheme, thus lowering pension contributions. Revenue from the auctioning of emission permits in emissions trading is also recorded as part of this statistic on environment-related taxes.

In 2021, revenue from environment related taxes amounted to 68 billion euros. The largest proportion came from the energy tax, 37.2 billion euros, followed by the motor vehicle tax (9.5 billion euros) and the revenues from national emissions trading (7.7 billion euros).

Environmental taxes have risen by around 23.3 % between 2005 and 2021, whereas overall taxes increased by 84.3 %. The share of environmental taxes in overall tax revenue is only 8.2 %. In 2005 it still was a share of 12.2 %.

The introduction of the Ecological Tax Reform in 1999 led to a substantial rise in revenue from environmental taxes until 2005. Revenue from environmental taxes fell slightly by 2010 because the Ecological Tax Reform led to a more economical use of energy and electricity. Price hikes and inflation had no effect on revenue, as the taxes are quantity taxes (e.g. 2 cents per kilowatt hour of electricity).

The concept of statistics on environmental taxes was developed at an international level by the Organisation for Economic Co-operation and Development (OECD) and the Statistical Office of the European Communities (Eurostat 2013). Reports on the development of environmental taxes are part of the Environmental Economic Accounting of the Federal Statistical Office of Germany (Destatis 2019, in German only).

More information: 'Umweltbezogene Steuern und Gebühren' (in German only).